TAG Oil Ltd. (TSXV: TAO and OTCQX: TAOIF) (“TAG Oil” or the “Company”), headquartered in Vancouver, BC, focuses on operations in the Badr Oil Field in the Western Desert of Egypt, positioning itself as a unique player in the MENA (Middle East North Africa) oil sector.

MENA: A Global Oil Powerhouse

The MENA region holds the largest global oil reserves, accounting for 57% of the world’s oil and 41% of its natural gas. OPEC member countries in MENA boast 840 billion barrels of proven crude oil reserves and approximately 80 trillion cubic meters of proven gas reserves.

Executive Vision

“While I believe in pursuing all sources of sustainable energy, oil and gas will continue to be a significant supplier of the energy mix for decades. MENA is a region with significant growth potential, and our team has the track record, expertise, and unified vision to get the job done.” — Abdel Badwi, TAG Executive Chairman.

Recent Developments

- Funding: Closed a CDN$12.3 million bought deal.

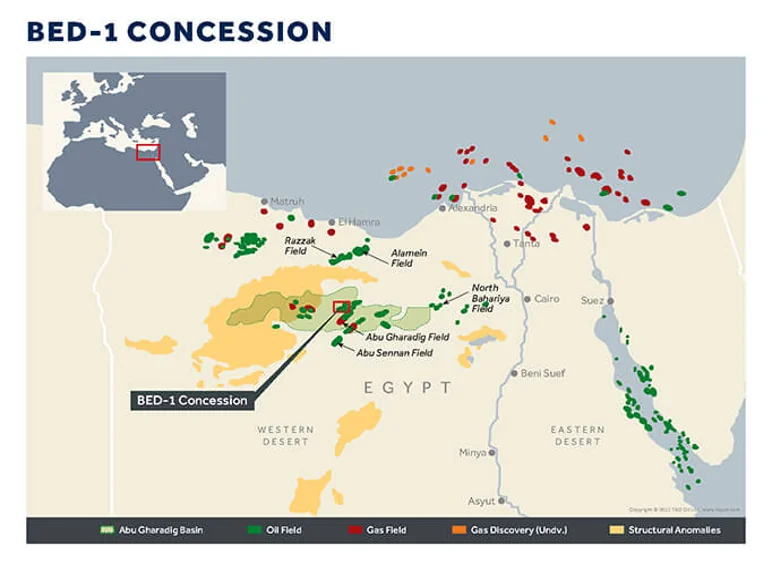

- Drilling: Active drilling at Badr Oil with promising oil shows at Abu Roash ‘F’ (ARF).

- Production: The BED 1-7 well, operational since April 2023, has achieved a cumulative production of approximately 10,000 barrels of oil from ARF.

- Future Planning: Success at ARF paves the way for further development of the BED-1 field.

The Badr Oil Field

TAG Oil holds an interest in the Badr Oil Field (“BED-1”), a 26,000-acre concession located in Egypt’s Western Desert, through a Production Services Agreement (PSA) with Badr Petroleum Company (BPCO).

Market Outlook and Projections

Research Capital has provided the following projections for TAG Oil:

- Rating: Speculative Buy

- Current Price: C$0.50

- Target Price: C$1.25

- Projected Return: 115.5%

- Market Cap: C$104.70 million

- Financial Position: TAG Oil remains debt-free with an estimated positive working capital of ~C$25 million. (Bill Newman, CFA Research Capital)

Oil Market Dynamics

Potential expansions of the Israel-Hamas conflict could push oil prices to between USD 100 and USD 157 per barrel. The highest recorded oil price was USD 147.5 per barrel in July 2008.

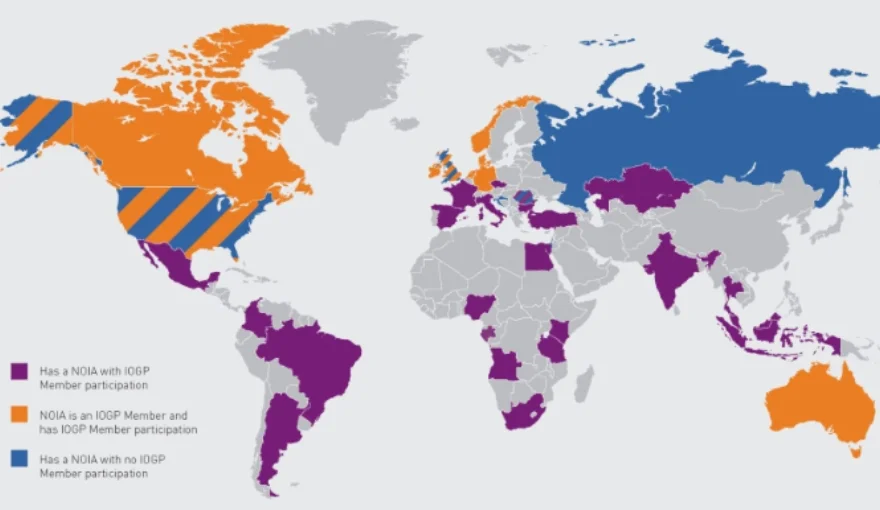

Investment Opportunities

Currently, there are no MENA-specific ETFs in the U.S. that cover the entire region; American investors can only access MENA through several sub-regional or country-specific ETFs. TAG Oil offers a unique opportunity for investors seeking exposure to this massive and active oil region.

MENA: A Region of Strategic Importance

Covering over 15 million square kilometers and home to about 6% of the world’s population, the MENA region is comparable in population size to the European Union. The region’s smallest countries (Bahrain, Djibouti, and Qatar) each have around half a million inhabitants, while the largest countries (Egypt and Iran) have about 60 million inhabitants each. These, along with Algeria, Morocco, and Sudan, account for about 70% of the region’s population, with nearly half residing in urban areas.

Conclusion

TAG Oil offers a compelling investment opportunity in the MENA region, the world’s largest oil reserve area. It should be a serious consideration for investors looking to diversify their portfolios with exposure to a strategically vital and resource-rich region.

No comment