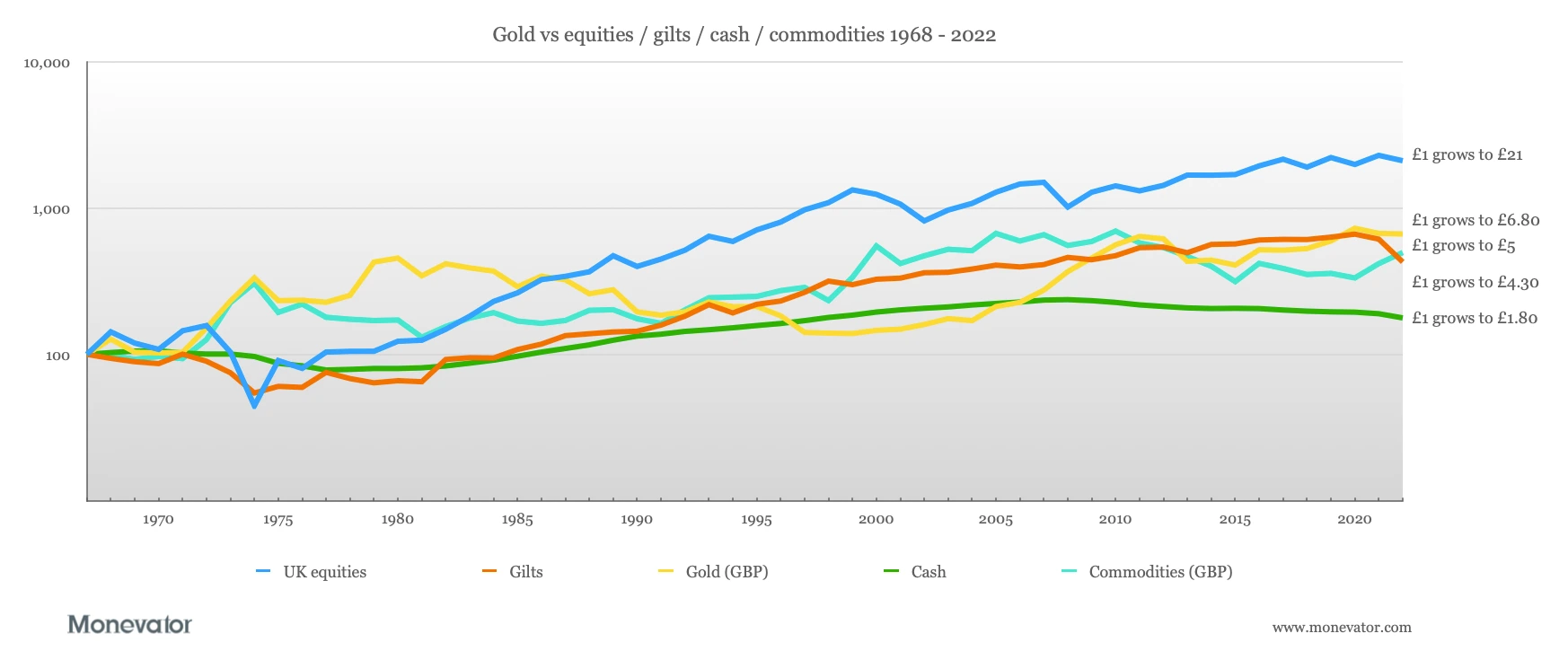

Gold Mining (NYSE American: GLDG) is a gold-focused royalty company providing innovative financial solutions to the metals and mining industry. Its mission is to acquire royalties, streams, and similar interests at different stages of the mine life cycle, aiming to build a balanced portfolio that offers attractive near-, medium-, and long-term returns for its investors. The accompanying chart demonstrates investor confidence in GLDG’s unique approach to capitalizing on gold through royalty financing.

The company’s royalty assets include properties in Alaska, La Mina in Colombia, the Tapajos Region in Brazil, São Jorge in Brazil, Nutmeg Mountain in the USA, and REA Uranium in Canada.

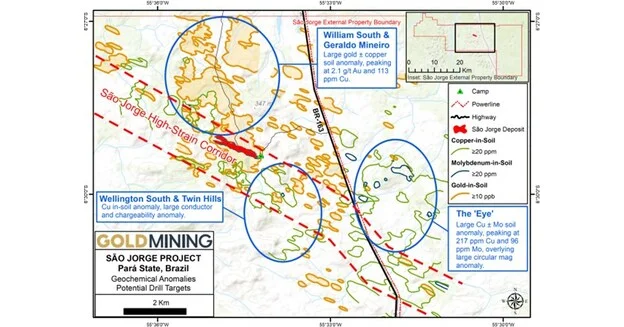

GLDG is also exploring gold assets. The Company announced an impressive drilling program at its 100%- owned São Jorge Project (“São Jorge” or the “Project”) in the Tapajós Gold district, Pará State, Brazil.

163 m at 1.02 grams per tonne (g/t) gold (Au) from 44 m downhole depth, including higher-grade intersections:

- 20 m at 1.37 g/t Au from 44 m depth;

- 37 m at 2.26 g/t Au from 95 m depth;

- 11 m at 1.00 g/t Au from 148 m depth;

- 13 m at 1.35 g/t Au from 166 m depth; and

- 12 m at 1.15 g/t Au from 195 m depth. (More assays in the June 18th PR.)

Tim Smith, VP of Exploration, commented: “The results from our first drilling at São Jorge in over a decade are promising and suggest an extensive corridor of mineralization with multiple intercepts. We believe these findings will enhance our geological model, increasing confidence in future mineral resource estimates. Additionally, we have begun the auger drilling phase of the program and look forward to providing further updates.”

Here is a detailed research report on GLDG and the Corporate deck for a deep dive into the Company.

GLDG provides financing for exploration and production and gets a royalty on each ounce produced or the weight unit for which the target commodity is measured. GLDG keeps working with the company to ensure growth for itself and its holdings. So far, so good. As I have said about others, GLDG is not just in the gold business; it is in a myriad of gold companies.

From a risk perspective—spoiler alert, there’s always risk—GLDG benefits from an additional layer of scrutiny, as the project evaluations have already been conducted for their review. This dual-level examination enhances the quality assurance of their holdings. Notably, investors should consider GLDG’s 15% stake in Gold Royalty Corp (GROY), a prominent gold royalty company. As GROY expands its portfolio with more producing royalties or advances its existing royalties towards production, its value proposition strengthens. While this isn’t a guarantee, it’s a logical expectation.

That means, very simply, that GLDG buys up mining projects when gold markets are relatively low, holds onto them until the right moment… and buys them when no one else wants them.

The bottom line is that GLDG provides investors with many advantages.

- Proxy for the gold market

- Relatively lower risk

- Exposure to more prominent and higher-quality gold companies

- Uranium is an example of GLDG moving ahead of the herd.

- A great example of a long-term hold.

- Cool Logo.

Additionally, the company is venturing into the uranium market. Currently, GLDG’s commodity exposure consists of 81% gold or equivalents, 18% silver, and 1% copper. Stay tuned as uranium enters the mix.

One strategy is to use GLDG as a long-term gold-holding proxy while trading the more volatile junior stocks around it. This approach not only makes trading more engaging but could also be profitable.

No comment